By David Urani

Taser (TASR) made a nice gain on Thursday after posting a Q1 earnings beat of $0.01 while also turning in revenue of $30.4 million, up 19% year over year vs. a $28 million consensus. Gross margin also improved to 61% from 59%. So it was a relatively solid result all around, driven with help from the next evolution of "smart" tasers that are more effective and safe due to their ability to adjust shock levels.

But, for me, the video and cloud business is the most compelling part as it's off to a good start and could become a big thing in law enforcement. The company introduced new AXON wearable video cameras in late 2011, along with a cloud storage network at Evidence.com. The cameras address the problem of $2.5 billion-plus annual police legal liabilities, while also holding police accountable as well. The cameras can be attached anywhere, such as on a pair of glasses, and at the end of the day the officer plugs the device into his or her computer and evidence is automatically uploaded to cloud storage.

Sales of TASR's video products were up 175% year over year in Q1, and bookings are up 394%. It still represented just 8% of sales at $2.4 million, but by 2017 the company sees it being 16%-34%. Other potential long-term drivers for TASR include weapon upgrades (by 2015 installed base five-plus years old will be up 48%) and international expansion, particularly in Latin America.

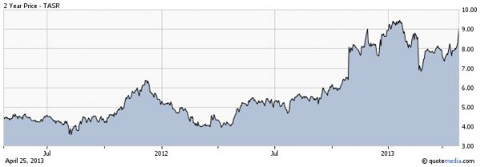

The biggest hang up for me is the valuation. TASR has a 28 forward P/E, although it's right in line with expected growth as its PEG is 1. The Street currently expects annual EPS growth of 30% over the next five years, which is roughly in the middle of TASR's 2017 guidance for $0.49-$1.10. TASR may be worth a look on any dips.